Local 3121 members rally outside of Ojus, Doral and Brentwood work centers to rally for our future. As bargaining stalls, our members are ready and willing to walk if need be to get a contract that can provide our members with a wage that can allow them to live in this inflationary economy we find ourselves in living in South Florida. Our Junior Wire Technicians, some making wages that don’t even allow them to afford renting an apartment or having reliable transportation to get to work, resign within 6 months. “It has been a major problem not being able to train and maintain a work force to provide essential services in the communities we serve because the job simply does not pay a living wage.” states President Local 3121 Johnny Motisi. “We need to bargain fair wages that are commensurate to the value of the services in the area we live and work in. Miami-Dade is no longer a sleepy little town, it’s the 7th most populated county in the country and like all other major cities it’s expensive. U.S News.com has Miami-Dade as the 3rd Most expensive areas to live in the Country. ” Link below as reference:

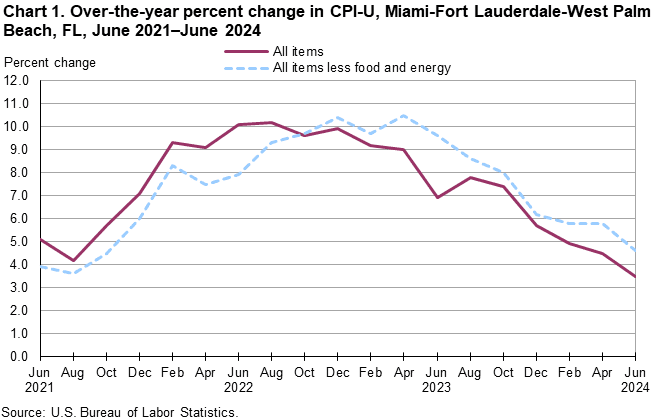

https://realestate.usnews.com/places/rankings/most-expensive-places-to-liveSince the global pandemic, the rate of inflation increased and stayed at rates not seen since the 1970’s. Prices increased across all indexes, food, gas, rent, and utilities as well as home owners and car insurance. Clothing, school supplies, automobile prices have all been rising as well as medical care and education. Buying a home is now a unreachable goal, once considered the American Dream, it is now an Illusion as interest rates are high and will remain elevated of the unforeseeable future; according to the Bureau of Labor Statistics, link below:

(https://www.bls.gov/regions/southeast/news-release/consumerpriceindex_miami.htm).

The rates at which inflation effects all aspects of American life can be felt and quantified, the real problem exists in the wage increases for ATT Bargained employees have not kept up with the acceleration in pricing. While it’s true that inflation has been going down recently, the only true measure of any economy is what the wages are versus the price of goods and services right now here in our market – Miami. Prices remain elevated and wages haven’t for awhile. It’s a real problem and the historically high credit card debt is a symptom of this problem as many must borrow to pay bills. According to lending tree, Credit Card debt is at an All-Time High $1.115 trillion, average credit card debt per household is $6,329. Research shows that Gen X carry the most debt ($9300) versus Millennials and baby boomers averaging $6,600, so it seems that it has affected everybody to different degrees.

The Federal Reserve of New York reported the following:

Household Debt Ticks Up to $17.80 Trillion in Second Quarter; Mortgage Originations Remain Low

Total household debt rose by $109 billion to reach $17.80 trillion, according to the latest Quarterly Report on Household Debt and Credit. Mortgage balances were up $77 billion to reach $12.52 trillion, while auto loans increased by $10 billion to reach $1.63 trillion and credit card balances increased by $27 billion to reach $1.14 trillion. The volume of mortgage originations remained low, primarily due to subdued refinancing activity. Homeowners continued to increase balances on home equity lines of credit (HELOC) as an alternative way to extract home equity; HELOC limits rose by $3 billion, marking the ninth consecutive quarterly increase. Aggregate delinquency rates remained unchanged from the previous quarter, with 3.2 percent of outstanding debt in some stage of delinquency.

Another quote from BankRate stated:

“While inflation has come down, broadly speaking, prices have not. There is a kind of continuing, virtual sticker shock that continues to weigh on the minds and pocketbooks of consumers that is meaningful.

” MARK HAMRICK | BANKRATE SENIOR ECONOMIC ANALYST

The Data doesn’t lie. Everything is too expensive and today’s wages no longer can sustain living in major cities in a two income household anymore, especially with borrowing costs being so high. Below is a chart with the rate of inflation from June 2021 to June 2024:

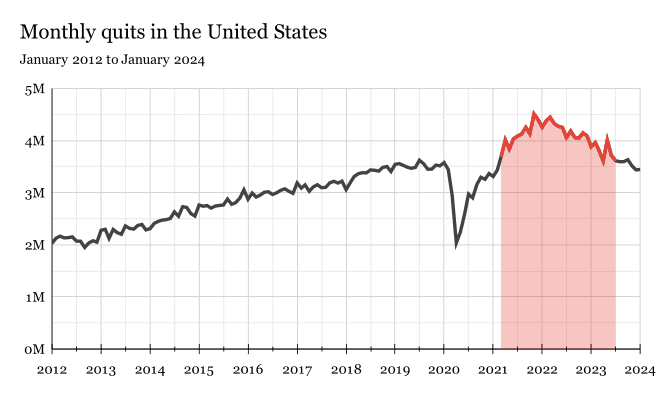

The current state of the economy needs to change, this is not a sustainable path and for those that are retired and on fixed income, those that are considering retirement, or those that are struggling to stay afloat. Elections are coming and issues like the Economy and Immigration, interest rates and inflation will be the top concerns of voters. The working class need to remain a top priority in the country, but if working families can’t sustain themselves, what reason would they have to not drop out of the labor market? That was a root cause during and after the Pandemic. The Great Resignation or The Big Quit as it was called. A total of 47 million Americans quit their jobs in 2021. And with $4.6 trillion is stimulus was paid out. There were many causes to the labor and wage debate but if we don’t give workers the fuel to work, ATT and the CWA may have a long drawn out battle ahead. And I’m Banking on the CWA to win that fight!